Despite the Salesforce Financial Services Cloud boasting powerful features, some of its top capabilities are still underrated. The underrated features of the Financial Services Cloud stem from a lack of awareness and access to training or a limited focus only on prominent functionalities.

Since it offers many opportunities and features profiting businesses in several ways, some of its leading abilities get overshadowed and require attention.

However, before getting into the depth of those undervalued features of the Financial Services Cloud, it is crucial to explore what it is and how it functions.

How Does Salesforce Financial Services Cloud Function?

Financial Services Cloud Salesforce is a specialized customer relationship management (CRM) platform tailored to meet the unique needs of financial services professionals. It operates as a centralized hub to connect different aspects of data, processes, and customer interactions.

It centralizes client information, structures workflows, and improves cooperation across teams to form a 360-degree view of clients. Some of its top features include:

- Wealth Management

- Banking and Lending

- Insurance

- Platform Power and Integration

Remember, these are just a few top features of Financial Services Cloud. Let’s talk about the underrated features that most people are not talking about.

Read Also: Expert Salesforce Implementation Services

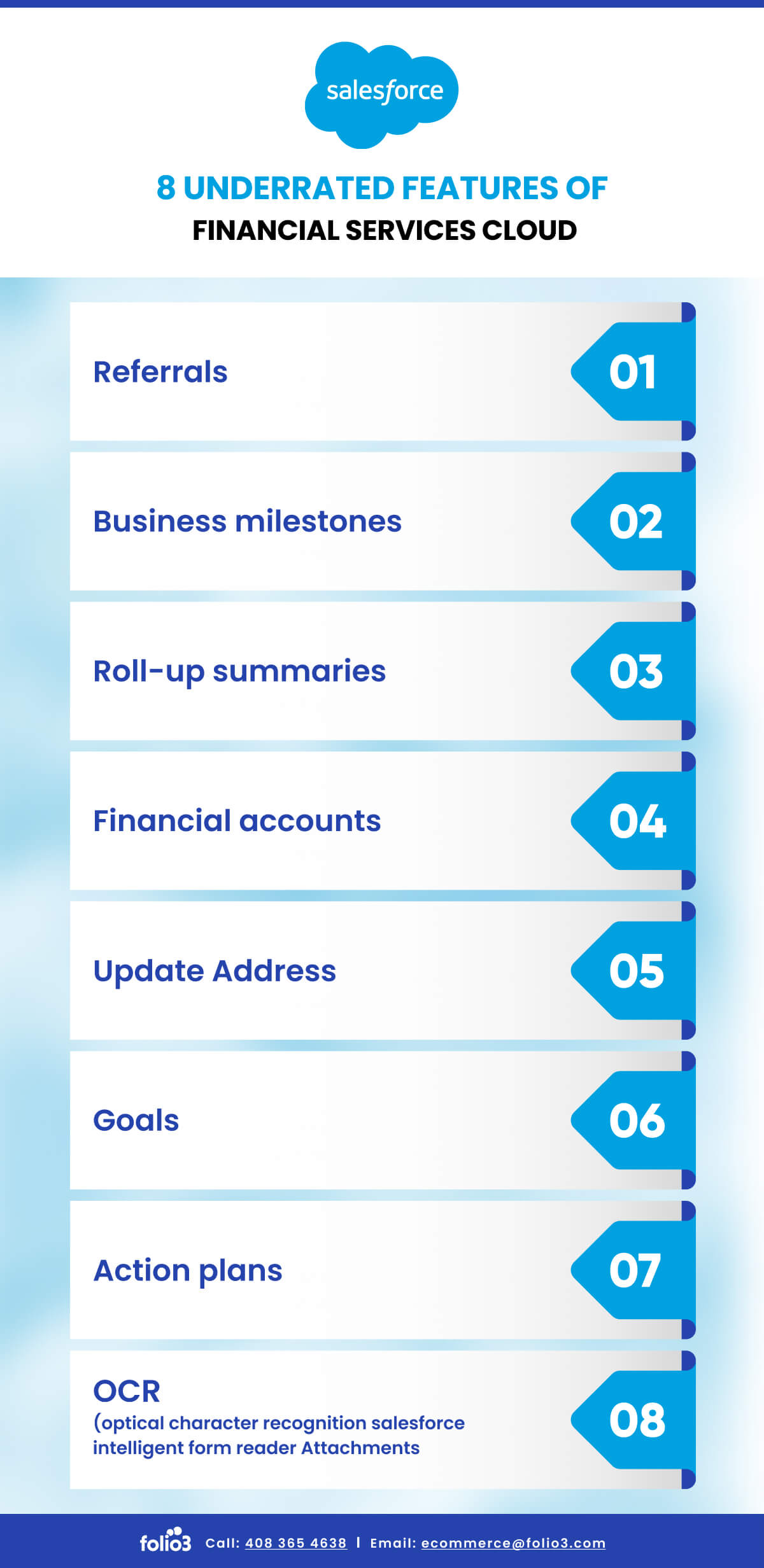

8 Underrated Features of Financial Services Cloud

Salesforce plays a massive role in the finance sector. Yet some of its features have been underrated for a long term. Here, we will list down and explain all those underrated Salesforce features of Financial Service Cloud because all the specific features of the services have something unique to offer for a smooth process.

- Referrals

- Business milestones

- Roll-up summaries

- Financial accounts

- Update address

- Goals

- Action plans

- OCR (optical character recognition- salesforce intelligent form reader

Referrals

Salesforce Financial Services Cloud simplifies collaboration through its strong “Referrals” feature. This tool is highly beneficial for allowing users to refer clients or opportunities within the system without hassle. Its smooth referring ability sets the Salesforce Financial Service Cloud apart from others.

Salesforce Financial Cloud induces a collaborative environment by facilitating the easy transfer of leads or clients among team members. This feature promptly informs relevant parties, thus promoting a single and coordinated approach to client management.

Above all, the organized referral process contributes to better communication and efficient handling of client relationships. It is biggest advantages of Salesforce Financial Services Cloud and make it best among all clouds.

Business Milestones

The term “Business Milestones” in Salesforce Financial Services Cloud helps users track and celebrate valuable achievements. Additionally, this feature plays a significant role in recognizing key milestones in client relationships or business operations.

The best part of this feature is that it provides a structured way to document and acknowledge accomplishments and promote a positive work culture. As a result, you can evaluate and celebrate milestones that contribute to a sense of progress to develop teamwork within the organization.

Roll-Up Summaries

One of the most underrated features of Financial Services Cloud is the “Roll-Up Summaries” feature. It is a powerful tool that combines data from related records while offering a comprehensive view of information. This quality summarizes data in a meaningful way. So that users can easily analyze and interpret the aggregated data via Salesforce Financial Cloud implementation.

In short, the aim is to help them make well-informed decisions. This feature is particularly important for gaining insights into client interactions and relationships, as it gives a complete perspective on the various elements contributing to a client’s profile.

Financial Accounts

When it comes to Financial Accounts, the Financial Cloud Salesforce gets an edge. Financial Accounts serve as a centralized hub for managing crucial monetary information.

With this feature, users can efficiently organize and access financial data related to clients. Providing a comprehensive overview of a client’s financial landscape also equips financial professionals with the data needed for strategic decision-making.

Lastly, the structured presentation of financial information improves efficiency and helps build a clearer understanding of a client’s financial position.

Update Address

Like other underrated features of Financial Services Cloud, the “Update Address” feature holds immense importance in the financial process.

It ensures the accuracy and currency of client information. After all, keeping customers’ addresses up-to-date is not only essential for compliance but for the sake of delivering personalized services as well.

Through this feature, users can simplify maintaining accurate client data by providing a user-friendly mechanism to update and validate addresses.

Goals

Goals in the Salesforce Financial Service Cloud are synonymous with a structured approach. The aim of this feature is to set and track objectives. It authorizes users to define clear goals, whether they are related to individual performance, team targets, or strategic initiatives.

The provision of a centralized platform for goal management enhances transparency and accountability. That is how users can monitor progress, celebrate achievements, and align efforts to end up in a goal-oriented and motivated work environment.

Action Plans

Every business today needs to implement goal-setting functionality. Action Plans in Salesforce Financial Services Cloud serve the cause. By rendering a framework, it outlines the steps to achieve those goals.

This is yet another feature of Salesforce 360 that facilitates creating, tracking, and managing action plans associated with specific objectives.

Users can also break down large goals into actionable tasks, assign responsibilities, and monitor progress. Overall, the structured approach enhances efficiency, communication, and the execution of strategic initiatives.

OCR (Optical Character Recognition) – Salesforce Intelligent Form Reader

The OCR – Salesforce Intelligent Form Reader feature employs advanced Optical Character Recognition technology to extract and interpret text from documents.

Due to this functionality, data entry processes become smooth. OCR makes data accurate by automating the extraction of information from physical or digital forms, reducing manual effort, and minimizing errors associated with manual data entry,

In particular, this feature is valuable for handling paperwork, for example, large client documents or forms, in a more streamlined and automated manner.

Conclusion

The underrated features of Financial Services Cloud make finance jobs more convenient. They empower finance professionals by providing a unified, efficient, and intelligent solution for client management and strategic planning in an ever-changing world of financial services.

Therefore, you must know about these underrated benefits that can help you attain a more holistic view of the Salesforce Financial Services Cloud.

As a Salesforce Financial Services Cloud consultant company, we collectively contribute to a comprehensive and efficient platform for management, collaboration, and planning in the financial services domain.

If you choose our Salesforce Financial Services Cloud services to their full potential, you can benefit from efficient client management, collaboration, and strategic decision-making in the financial services sector. So, are you ready for it?

FAQs

What is the financial services cloud in Salesforce?

The Salesforce Financial Services Cloud is a specialized customer relationship management (CRM) platform designed for the financial services industry, offering tailored tools for enhancing client relationships, managing accounts, and ensuring regulatory compliance. It integrates sales, service, and marketing to provide a comprehensive and personalized customer experience across various financial sectors.

How is financial services cloud specialized for the financial services industry?

The Financial Services Cloud in Salesforce is specialized for the financial services industry by offering a 360-degree view of clients’ financial profiles, integrating with banking and insurance platforms, and providing custom tools for managing financial accounts and client goals. It enhances productivity and personalization in customer interactions, specifically tailored to sectors like wealth management, banking, and insurance.

What is the main function of the financial services industry?

The main function of the financial services industry is to manage money and facilitate various financial transactions for individuals, businesses, and governments. This includes services such as banking, investment, insurance, and wealth management, aimed at helping clients manage their finances, invest for growth, and safeguard their economic interests.

Hasan Mustafa

Engineering Manager Salesforce at Folio3

Hasan Mustafa delivers tailored Salesforce solutions to meet clients' specific requirements, overseeing the implementation of scenarios aligned with their needs. He leads a team of Salesforce Administrators and Developers, manages pre-sales activities, and spearheads an internal academy focused on educating and mentoring newcomers in understanding the Salesforce ecosystem and guiding them on their professional journey.