Summary: Agentforce for Insurance

- Agentforce solves critical operational challenges, including claims processing delays, fraud detection gaps, customer experience inconsistencies, and workforce capacity constraints.

- Six practical use cases demonstrate how Agentforce transforms insurance operations: live chat with policy adjustments, real-time risk assessment, instant fraud detection, dynamic premium recalculation, sentiment analysis during calls, and mobile document verification

- Implementing autonomous AI agents requires more than technology it demands strategic planning around data foundation, compliance frameworks, and change management.

- Folio3 provides comprehensive Agentforce implementation services, including strategic planning, Salesforce Financial Services Cloud optimization, integration with existing systems, and ongoing managed services.

The insurance industry faces a talent crisis. With 50% of insurance professionals nearing retirement in the next 15 years and 400,000 unfilled positions expected by 2026, insurers need technology that fundamentally transforms operations.

Agentforce for Financial Services moves beyond basic automation. This autonomous AI platform from Salesforce handles complex workflows from claims processing to fraud detection while human professionals focus on strategic decisions and relationships requiring judgment. To understand the underlying mechanics, explore how Agentforce works.

Insurers leveraging Agentforce for Insurance for automating report a 30% reduction in operational costs, while UK insurer Aviva cut liability assessment time by 23 days and reduced customer complaints by 65%.

Why Insurance Companies Need Agentforce

The insurance sector stands at a crossroads. Traditional operational models are buckling under three converging pressures that threaten competitiveness and profitability.

The Talent Crisis Has Reached Critical Mass

Over the next 15 years, 50% of the current insurance workforce will retire, leaving more than 400,000 open positions unfilled. The average insurance professional is in their mid-50s, and the US Bureau of Labor Statistics anticipates a decline in insurance underwriting and claims adjustment professions from 2022 to 2032 due to automation and increased efficiency.

The talent shortage creates a vicious cycle. Remaining employees stretch themselves thin covering gaps, fielding frustrated customer calls, and burning out. Without intervention, carriers lose additional talent to burnout, deepening the crisis.

Customer Expectations Have Fundamentally Changed

Customer loyalty to insurance providers is down 28% post-pandemic. Almost a third (29%) will churn after one negative experience. Customers accustomed to Amazon’s one-click ordering and Netflix’s personalized recommendations expect the same frictionless experience from their insurers.

Key customer demands include:

- Instant quotes available 24/7 without waiting for business hours

- Claims resolved in hours, not weeks

- Seamless omnichannel experiences across mobile, web, and phone

- Personalized policy recommendations based on individual needs

- Transparent pricing that reflects actual risk, not broad demographics

With insurtech companies providing convenient digital experiences, customers have plenty of options. Traditional carriers that fail to modernize their customer experience will hemorrhage policyholders to more agile competitors.

Operational Costs Continue Rising

AI-powered claims automation is now reducing processing time by up to 70%, saving insurers an estimated $6.5 billion annually. Carriers that fail to capture these efficiency gains will find themselves at an increasing cost disadvantage.

Agentforce addresses all three pressures simultaneously. It multiplies workforce productivity by handling routine tasks autonomously, delivers the instant, personalized customer experiences modern consumers demand, and dramatically reduces operational costs through intelligent automation. This represents how Salesforce Agentforce is changing the game for insurance carriers facing existential competitive threats.

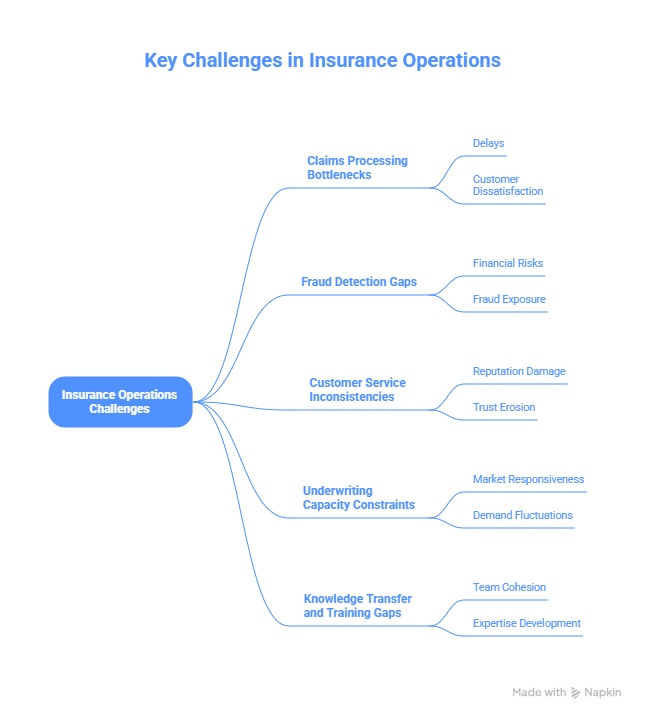

Which Key Challenges Does Agentforce for Insurance Solve?

Agentforce tackles the most persistent operational challenges that plague insurance operations and impact both the bottom line and customer satisfaction.

Claims Processing Bottlenecks

Traditional claims processes involve multiple handoffs, manual data entry, document verification, and assessment delays. A typical auto claim might require: initial intake, adjuster assignment, photo review, damage assessment, repair authorization, and payment processing. Each step introduces a delay and the possibility of errors.

Agentforce transforms this workflow. Claims processing time has been reduced by 55-75% through AI automation, with routine claims processing experiencing a 75-85% time reduction from 7-10 days to 24-48 hours. The platform handles intake, verifies policy details, analyzes damage photos using computer vision, cross-references repair cost databases, and can approve straightforward claims without human intervention.

Fraud Detection Gaps

Insurance fraud costs the industry billions annually. Traditional fraud detection relies on rules-based systems that flag obvious red flags but miss sophisticated fraud schemes. By the time human investigators catch patterns, significant losses have already occurred.

Machine learning in underwriting has improved accuracy by 54%, leading to more reliable and data-driven risk assessments. Agentforce implementation applies similar capabilities to fraud detection, analyzing claim patterns across millions of records to identify anomalies that would be impossible for humans to spot. The system learns continuously, adapting to new fraud tactics in real-time.

Customer Service Inconsistencies

Insurance customer service suffers from inconsistency. Agent knowledge varies, wait times fluctuate, and service quality depends on who answers the phone. This variability damages trust and drives customer dissatisfaction.

Chatbots and virtual assistants handle 42% of customer service interactions in 2025, significantly boosting efficiency and satisfaction. Agentforce provides consistent, accurate responses 24/7. Every customer receives the same high-quality service regardless of when they contact the company or which channel they use.

Learn more about implementing Agentforce for customer service across insurance operations.

Underwriting Capacity Constraints

Manual underwriting creates bottlenecks that slow policy issuance and limit growth. Underwriters spend hours gathering information, assessing risk, and pricing policies. This labor-intensive process caps how many applications an organization can handle.

Agentforce automates routine underwriting tasks, allowing human underwriters to focus on complex risks that require expertise and judgment. The system pre-fills applications, performs initial risk assessments, recommends coverage levels, and even generates initial quotes for standard policies. Policy coverage verification has seen a near-99% time reduction, dropping from 15-20 minutes to mere seconds.

Knowledge Transfer and Training Gaps

As experienced professionals retire, their knowledge walks out the door. Training new employees traditionally requires months of shadowing and mentoring resources companies increasingly can’t spare.

Agentforce captures institutional knowledge in its AI models. New employees can lean on AI agents for guidance, learning best practices embedded in the system. This dramatically accelerates onboarding while ensuring consistency in how tasks are performed.

Agentforce for Insurance: Use Cases

Let’s examine six specific use cases that demonstrate how Agentforce transforms insurance operations in practice.

Agentforce Use Case #1: Live Chat Support with Instant Policy Adjustments

Traditional insurance customer service follows a frustrating pattern. A policyholder contacts their insurer to update coverage, add a driver, or change their deductible. The agent takes the information, promises to process the request, and says someone will follow up. Days pass. The customer calls back. The cycle repeats.

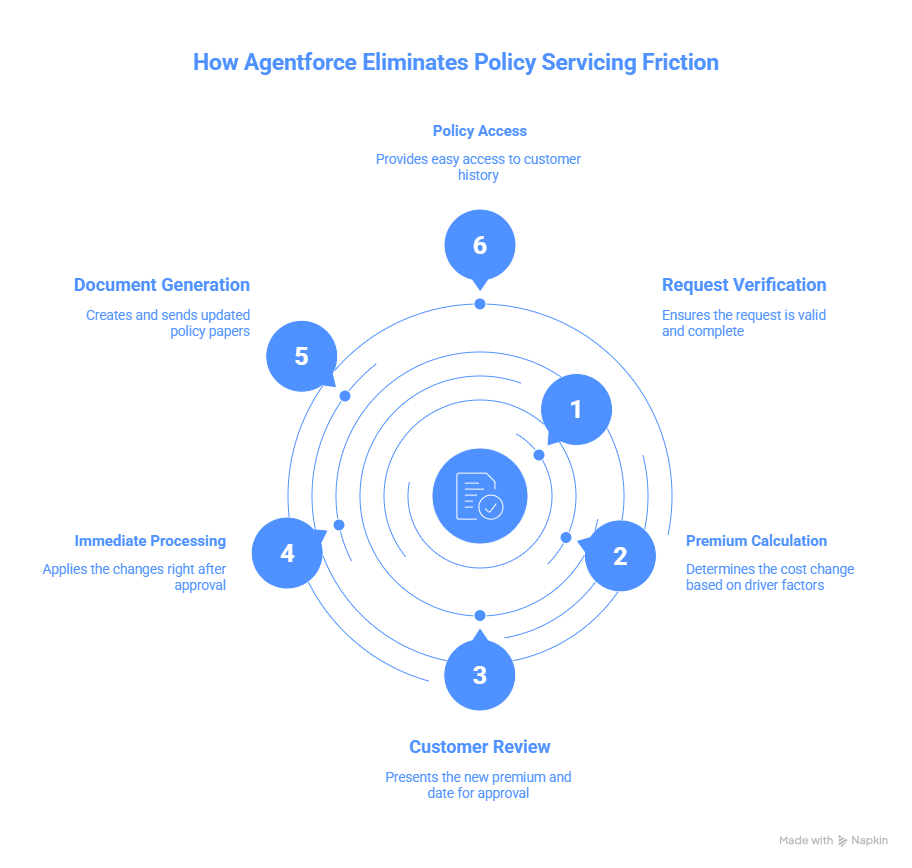

How Agentforce Eliminates Policy Servicing Friction

Agentforce eliminates this friction through autonomous policy servicing agents. When a customer initiates a chat requesting to add their teenage daughter to their auto policy, the AI agent handles the entire transaction in real-time.

The agent performs these actions instantly:

- Accesses the customer’s policy details and coverage history

- Verifies the request and calculates the premium impact based on driver’s age and record

- Presents the new premium and effective date for customer review

- Processes the endorsement immediately after customer approval

- Generates updated policy documents and sends confirmation

The entire interaction takes minutes, not days. What makes this powerful isn’t just speed it’s the combination of instant processing with natural language understanding. The customer doesn’t navigate through multiple screens or wait on hold. They simply state their need, and Agentforce orchestrates the necessary system updates, compliance checks, and documentation automatically.

The business impact extends beyond customer satisfaction. As part of its customer-centric transformation, one insurer trained 35 percent of its employees and virtually all of its agents on CX capabilities.

In addition to doubling its customer experience scores, the insurance carrier experienced a 25 percent reduction in processing times as well as meaningful improvements in cross-sell and retention rates. These principles apply equally to Agentforce for commerce platforms where instant transaction processing drives conversion.

Agentforce Use Case #2: Real-Time Risk Assessment During Client Onboarding

New business applications represent a critical moment of truth. Customers want instant decisions. Insurers need an accurate risk assessment. Traditional processes force a tradeoff between speed and thoroughness.

Autonomous Underwriting in Action

Agentforce eliminates this tradeoff through autonomous underwriting agents that perform comprehensive risk assessment in real-time during client onboarding.

Consider a small business owner applying for commercial general liability coverage. As they complete the online application, Agentforce works behind the scenes:

- Pulling credit reports and checking loss history with industry databases

- Analyzing the business location for environmental and crime risk factors

- Reviewing industry-specific hazard data and safety records

- Comparing the application against the underwriting guidelines

- Identifying upsell opportunities based on industry benchmarks

Within minutes, the agent provides a decision: approved with standard terms, approved with conditions, or referred to a human underwriter for complex evaluation. For the majority of applications, the customer receives an instant quote and can bind coverage immediately.

65% of UK insurers use AI for risk evaluation, up from 48% in 2023, demonstrating rapid year-over-year growth of 35% and indicating strong momentum in this critical area. This adoption acceleration reflects the measurable business impact of AI-powered underwriting.

Agentforce Use Case #3: Instant Fraud Detection Alerts for Suspicious Claims

Insurance fraud schemes grow increasingly sophisticated. Traditional detection methods catch blatant fraud the staged accident, the inflated repair bill but miss complex schemes that involve legitimate-looking documentation and plausible narratives.

Pattern Recognition That Spots What Humans Miss

Agentforce employs advanced pattern recognition to identify suspicious claims the moment they’re filed, analyzing claims against millions of historical records to detect anomalies.

When a homeowner files a water damage claim, Agentforce simultaneously checks weather data for the claimed date and location, examines the policyholder’s claim history, compares damage photos against typical water damage patterns using computer vision, reviews repair cost estimates against market rates, and flags inconsistencies in the claim narrative.

If the system detects red flags perhaps the weather data shows no precipitation, or the damage pattern is inconsistent with the claimed cause it immediately alerts the Special Investigations Unit with a detailed analysis of suspicious elements.

Predictive analytics has increased fraud detection rates by 28%, helping insurers recover or avoid hundreds of millions in losses annually. This represents a direct bottom-line impact that justifies AI investment on its own.

The system improves over time. As investigators close cases, Agentforce learns which factors truly indicate fraud versus which are benign anomalies. This continuous learning makes the fraud detection increasingly accurate and reduces false positives that waste investigative resources.

Agentforce Use Case #4: AI-Powered Dynamic Premium Recalculation

Traditional insurance pricing relies on static rating factors applied at policy inception and renewal. This approach fails to capture how risk actually changes over time. A driver’s habits may improve significantly, but they continue paying premiums based on outdated assessments.

Continuous Pricing That Reflects Actual Risk

Agentforce enables truly dynamic pricing through autonomous rating agents that continuously monitor risk factors and adjust premiums in real-time.

For auto insurance, the agent integrates with telematics systems to track actual driving behavior miles driven, time of day, hard braking events, and phone usage while driving. As patterns emerge, the agent recalculates the premium in real-time.

A customer who significantly reduces their annual mileage by switching to remote work sees their premium automatically adjust downward. Another customer whose driving data shows risky behavior receives coaching messages and premium adjustments that reflect their actual risk profile.

In 2025, 47% of insurers use AI-driven pricing models in real time, enhancing both pricing precision and profit margins. This shift from periodic repricing to continuous pricing optimization represents a fundamental change in how insurance operates.

The transparency builds trust. Customers see exactly how their behavior impacts their premium. They understand they’re being charged fairly based on their actual risk, not generalized demographics. This transparency differentiates carriers in competitive markets.

Agentforce Use Case #5: Live Customer Sentiment Analysis During Calls

Customer service calls carry emotional weight. An angry policyholder calling about a claim denial represents both a retention risk and an opportunity to build loyalty through exceptional service. Traditional quality monitoring reviews calls after the fact, missing opportunities to intervene when it matters most.

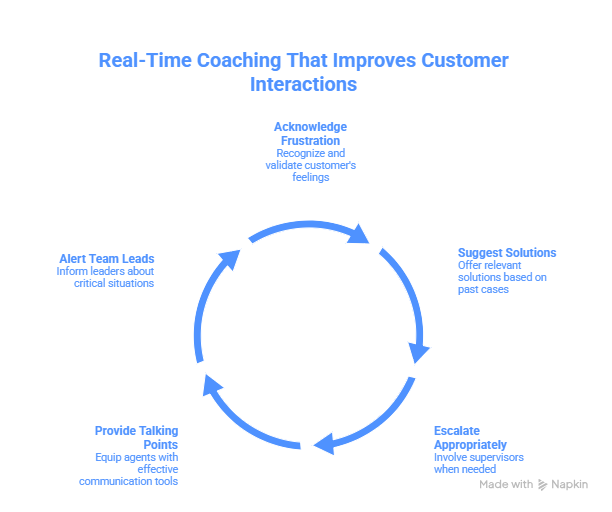

Real-Time Coaching That Improves Customer Interactions

Agentforce provides real-time sentiment analysis that gives agents superpowers during customer interactions.

As a call progresses, the AI analyzes the customer’s tone, word choice, and speaking pace to gauge emotional state. When sentiment indicators suggest frustration or anger is escalating, the system provides instant guidance:

- Acknowledging the customer’s frustration explicitly

- Suggesting specific solutions based on similar resolved cases

- Offering to escalate to a supervisor when appropriate

- Providing talking points that address common concerns

- Alerting team leads to monitor highly emotional interactions

After the transformation, 80 percent of transactions moved online, and customer satisfaction scores, specifically on how likely a customer is to refer an insurer, increased dramatically. This demonstrates the business impact of AI-enhanced customer interactions.

The sentiment data also flows back into quality assurance and training programs. Managers can identify patterns perhaps certain claim types consistently generate negative sentiment and address root causes rather than just coaching individual agents.

Agentforce Use Case #6: On-the-Go Document Verification via Mobile Capture

Policy servicing and claims processing historically required physical documents mailed to the insurer or uploaded through web portals. This introduces delays and friction that frustrate customers and slow operations.

Mobile-First Document Processing

Agentforce enables instant mobile document verification through computer vision and OCR technology integrated into customer-facing mobile apps.

When a customer needs to add a newly purchased vehicle to their policy, they simply photograph the registration card with their smartphone. Agentforce’s document agent automatically extracts the VIN, make, model, and ownership information, cross-references the VIN against manufacturer databases to populate vehicle specifications, verifies the customer as the registered owner, and updates the policy with the new vehicle information.

The entire process takes seconds. No scanning, no uploading, no manual data entry by either the customer or an insurance employee.

For claims, customers can photograph accident damage from multiple angles. The AI agent analyzes the images to identify the type and extent of damage, estimates repair costs using historical data and current market rates, and initiates the claims process with all necessary documentation already captured.

In the insurance industry, OCR can be used to automate various stages, particularly in underwriting and claims processing, where document data is automatically captured into systems. This automation eliminates one of the most tedious and error-prone aspects of insurance operations.

Beyond insurance, Agentforce delivers transformative value across multiple industries including healthcare, real estate, and HR service delivery. Each sector benefits from autonomous agents tailored to industry-specific workflows and compliance requirements.

How Folio3 Can Be Your AI Strategic Partner

Implementing Agentforce successfully requires more than purchasing software. It demands strategic planning, technical expertise, change management, and ongoing optimization.

Strategic Planning and Discovery

Our approach starts with understanding your specific operational challenges and business objectives. We don’t sell off-the-shelf solutions we architect AI-powered workflows that align with how your insurance organization actually operates.

Our Salesforce implementation service methodology begins with a thorough discovery process where we map current processes, identify automation opportunities, assess data readiness, and define success metrics.

Data Foundation and Integration

Many insurers attempt Agentforce implementations without an adequate data foundation. They quickly discover that AI agents are only as good as the data they access. Folio3’s Salesforce Financial Services Cloud expertise ensures your data model is optimized before deployment. We consolidate policy, claims, and customer data from disparate systems into unified customer profiles that give Agentforce agents comprehensive context.

Integration represents another common stumbling block. Insurance companies run on complex technology ecosystems policy administration systems, claims platforms, document management systems, and third-party data sources.

Our integration services connect Agentforce seamlessly with your existing infrastructure, ensuring AI agents can access the information and systems they need to operate autonomously.

Compliance and Risk Management

Compliance can’t be an afterthought when deploying AI in regulated industries. Folio3 builds compliance controls directly into Agentforce implementations through Salesforce automation services.

Every agent action follows your firm’s compliance rules, including required disclosures, approval workflows, and audit trails. This ensures automation doesn’t create regulatory risk.

Change Management and Training

Change management determines whether employees embrace or resist AI transformation. We’ve seen implementations fail not because the technology didn’t work, but because employees felt threatened or didn’t understand how to work alongside AI agents. Our approach includes comprehensive training programs that help insurance professionals understand how AI augments rather than replaces their roles, building confidence through hands-on practice with AI agents before go-live.

Ongoing Optimization and Support

Post-implementation, our managed services ensure your Agentforce implementation continues evolving. We monitor agent performance, optimize workflows based on usage patterns, add new capabilities as your needs expand, and maintain platform health through proactive support.

For insurers migrating from legacy systems, our Salesforce migration services ensure seamless data transition without business disruption.

FAQs

What is Agentforce for insurance?

Agentforce is Salesforce’s autonomous AI platform that deploys agents to handle complex insurance workflows policy servicing, claims processing, underwriting, and fraud detection with minimal human intervention while maintaining compliance guardrails.

Similar implementations across healthcare and marketing demonstrate versatility across regulated industries.

How does Agentforce differ from traditional chatbots?

Traditional chatbots follow pre-programmed scripts. Agentforce agents use large language models to understand context, access data from multiple systems, take autonomous actions like processing claims, and learn from each interaction to improve over time.

What ROI can insurers expect from Agentforce implementation?

Insurers report 30-50% reduction in operational costs, 25-40% improvement in customer satisfaction, 50-75% decrease in processing times for routine transactions, and 20-35% reduction in staff burnout and turnover.

Is Agentforce compliant with insurance regulations?

Yes. Agentforce includes embedded compliance controls with required disclosures, approval workflows for high-risk decisions, complete audit trails, and data privacy protections. Custom compliance rules are built during implementation.

How long does Agentforce implementation take?

A focused single-use-case implementation takes 8-12 weeks. Comprehensive deployments across multiple departments typically require 4-6 months. Phased approaches allow quick value realization through pilot programs.

Can Agentforce integrate with our existing insurance systems?

Yes. Agentforce integrates with all major policy administration systems, claims platforms, document management systems, and customer data platforms through custom APIs and middleware connections.

Will Agentforce replace our insurance agents and adjusters?

No. Agentforce handles routine tasks while insurance professionals focus on complex situations, relationship building, and strategic decisions. Most insurers redeploy staff to higher-value activities rather than reducing headcount.

What data foundation does Agentforce require?

Agentforce requires unified customer data including policy histories, claims records, customer interactions, and relevant third-party data. The platform works with imperfect data but delivers better results with consolidated, clean customer information.

Hasan Mustafa

Engineering Manager Salesforce at Folio3

Hasan Mustafa delivers tailored Salesforce solutions to meet clients' specific requirements, overseeing the implementation of scenarios aligned with their needs. He leads a team of Salesforce Administrators and Developers, manages pre-sales activities, and spearheads an internal academy focused on educating and mentoring newcomers in understanding the Salesforce ecosystem and guiding them on their professional journey.