Salesforce for

Financial Industry

Develop deeper relationships & maximize your client value with Salesforce solutions for Finance

Folio3 has been trusted by a variety of financial clients for salesforce needs spanning from insurance to banking to wealth management for more than a decade years.

- Home

- Verticals

- Salesforce for Financial Industry

Importance of CRM in the Financial Services Industry

Financial Services Industry Challenges

The financial services industry has undergone a fundamental shift for many years now. Emphasis on digital transformation has increased in recent years and aside from exceeding customer expectations and remaining competitive, here are some other major challenges that are faced by the financial institutes:

Regulatory

Compliance

View More

Regulatory Compliance

Aging Industry Applications

View More

Aging Industry Applications

Smarter Consumers

View More

Smarter Consumers

Digital Transformation

View More

Digital Transformation

Complete Contact Administration

View More

Complete Contact Administration

Integration Functionality Is Missing

View More

Integration Functionality Is Missing

Lack of User

Adaption

View More

Lack of User Adaption

Complicated Implementation

View More

Complicated Implementation

Why Choose Salesforce for your Business Needs?

Salesforce Customer Success Metrics Survey

How Can Folio3 Help?

Folio3 has been a leading force in the financial sector, giving entire salesforce solutions to help our clients get the most out of their money. We are a one-stop shop for all your Salesforce Financial Service Cloud needs, from cosntulting, development through Salesforce Managed Services. Our certified salesforce developers are experts in delivering the following services:

Financial Services Cloud Consultation

Financial Service Cloud Implementation

Financial Service Cloud Migration

Financial Services Cloud Customization

Financial Services Cloud Maintenance and Support

App development

3rd Party Integration Service

What sets us apart from the rest?

Clients (banks, booksellers, software giants, game start-ups) that trust and value us enough to be our best spokespersons.

Clients (banks, booksellers, software giants, game start-ups) that trust and value us enough to be our best spokespersons.

Employees who understand the dual commitment at Folio3, Customers first, Employees forever.

Web and Mobiles solutions are made with love, integrity, and lots of caffeine.

Tailored Approach for all Financial Services Institutes

Digital transformation has dramatically changed the financial services landscape. Manual processes, as well as redundant labor and time-consuming systems, have no place in the modern financial sectors.

Folio3 understands these challenges and provides a successful balance between in-depth industry knowledge and digital transformation expertise.

Our certified salesforce financial services cloud consultants deliver the right combination of customized salesforce solutions aligned with your business needs and objectives. We cater all the major financial service sectors:

Consumer and

Retail Banking

Wealth and Investment

Services

Investment banking and

capital markets

insurance

Benefits of Implementing Salesforce Financial Services Cloud

Salesforce Financial Services Cloud provides access to a plethora of opportunities. Powered by Lightning, Financial Services Cloud means success and growth for financial services companies regardless of whichever finance-related industry you are in. Some of the key benefits of implementing Financial Services Cloud are:

Client Relationship Management that is Defined and Deep

Any adviser can quickly develop and maintain an engaging relationship with their clients using Salesforce Financial Service Cloud, which includes data models and business processes. Advisors can progress from managing a single client relationship to managing entire families of accounts and even integrating third-party applications to manage such relationships.

Actions that are smart

To preserve compliance and maximise productivity, most financial advisors rely on paper-based SOPs, or Standard Operating Procedures, but consumers want a more engaging and social experience than a standard phone call. Advisors can effectively manage their financial client goals and develop their business by acting proactively.

Client Engagement in Real-Time

Businesses may have traditional clients, but they may also have new generation clientele that anticipate more technology-driven interactions. They might anticipate your presence on mobile apps, easy access to information, more self-service capabilities, and increased transparency. Agents may engage with their clients on their preferred channel and offer them real-time information with the help of Salesforce Financial Service Cloud.

Analytical Techniques

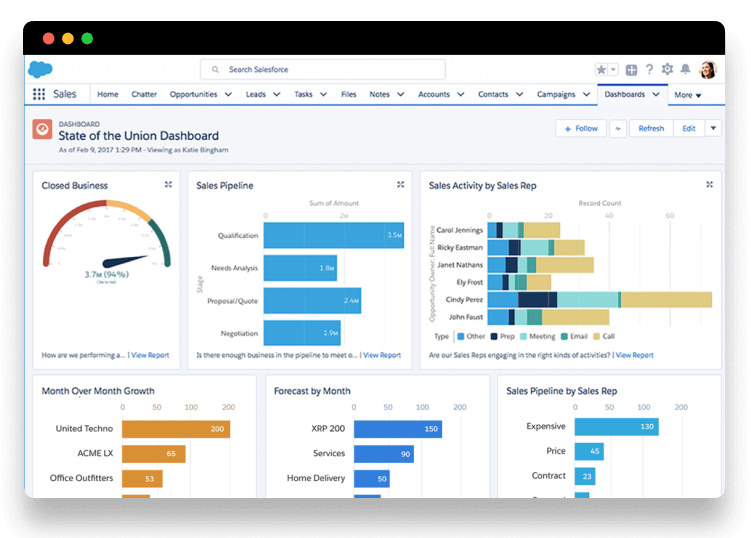

Financial Services Cloud, like all Salesforce solutions, includes a built-in analytics dashboard that uses powerful AI. The configurable Salesforce dashboard and reporting capabilities enable your financial team to make better data-driven decisions, which can help your company expand and generate more money. Salesforce Financial Services Cloud aids in the management of your company’s whole financial lifecycle. Financial Service Cloud offers several benefits for firms who wish to streamline their finance operations or extend their customer base, whether for budgeting, forecasting, reporting, or Salesforce dashboards.

Make your online banking experience even better.

Salesforce connects financial institutions’ digital touchpoints, giving you complete visibility into your most valuable asset: your customers. Implement agile, automated, and all-powerful solutions to transform the way you provide financial services in order to meet tomorrow’s rising expectations.

Lead Tracking Made Simple

When it’s critical to maintain a tight check on leads and referrals, Financial Services Cloud makes it simple. It enables you to maintain track of leads by utilising integrated partner apps and other powerful capabilities inside the Salesforce ecosystem. It also includes sophisticated referral features that can assist your finance staff in keeping track of referrals. When a lead is converted, the system creates an account and an opportunity for you.There are built-in industry standards.

Salesforce connects financial institutions’ digital touchpoints, offering you a 360-degree view of your most valuable asset: your customers. Implement adaptable, self-contained, and all-powerful solutions that will change the way you provide financial services in the future to satisfy rising demands.

Trusted By The Companies

A global Salesforce certified partner with over 12 years of experience

More Salesforce Success Stories

Folio3 helped MajorKey in merging two separate SalesForce Companies into one. Through the merger, we achieved the following objectives for MajorKey

- Single source of Sales Data

- Improved Analytics & Reporting

- Streamlined Financial Visibility

- Enabled Sales Cross/Upselling

- Reduced Administrative overheads

- Improved Sales Visibility

- Reduced Licensing Costs

Gabrielle Sampson

Business Consultant

200+

MajorKeys

$100+Million

Evo Systems is a U.S.-based company that manufactures windows, doors, glass and related specialty parts to the construction industry.

Folio3 helped Evo Systems build Multiple Salesforce connectors to help enrich their CRM experience.

The connector achieved the following benefits for Evo Systems.

- Seamless communication between Salesforce and other systems.

- Opportunity Management in Salesforce

- Deal Management in Salesforce

- Proposal Management in Salesforce

Evo

Distribution

50 - 100+

Evo Systems

$100+Million

Salesforce Financial Services Cloud Implementation Support for an independent Wealth Management firm

Our client is an independent wealth management firm located in Silicon Valley. They help their customers navigate the financial and personal challenges that come with change and complexity and also ask them big questions about what they want from their lives.

Folio3 helped this client with supporting their Salesforce Financial Services Cloud Implementation through the below activities:

- Address Management

- Data Migration

- Workflows and Templates

- End user training

- Dashboards and Reporting

- Box, Google Ads, MailChimp Integration

Wealth Management Firm

Financial

50 - 100+

$100+Million

Mountain View, CA USA

The customer is a Global Medical Device Manufacturing company specializing in Neuromodulation, Vagal Nerve Stimulation (VNS), Neuroscience, and Bioelectronic Medicine.

Our client is an independent wealth management firm located in Silicon Valley. They help their customers navigate the financial and personal challenges that come with change and complexity and also ask them big questions about what they want from their lives.

With a mission to help patients across the globe who suffer from pain and chronic conditions, they fulfill this goal by harnessing the power of nVNS, innovation, and technology to develop safe and clinically backed treatments.

- Streamlining workflows

- Data Migration

- Improvement in managing clients’ records

- A self-service portal

- Einstein Opportunity Insights

- Dashboards and Reporting

- Deliver personalized advice across channels

Device Manufacturing Company

Healthcare

50 - 100+

$100+Million

Basking Ridge, NJ USA

Our experience with Folio3 has been beyond expectations. Folio3 has completed multiple Salesforce development projects as well as provided suggestions for enhancements for our CRM. The workshops were planned with my team and discussed in detail. Folio3 brings the expertise needed for our organization.