Salesforce Financial Services Cloud Consultant

Turn Salesforce FSC into a Connected Financial Hub

Lead fintech and other growth-driven industries with a CRM powered by Salesforce Financial Services Cloud Consultant. We help banks, insurers, and wealth firms scale smarter and faster.

Our Certifications

Work with some of the most experienced certified Salesforce consultants and specialists, boasting expertise across the entire ecosystem.

Our Salesforce Financial Services Cloud Consulting & Implementation Solutions

Custom Fintech CRM Solutions

We tailor Salesforce Financial Services Cloud to fit your institution’s structure, products, and workflows, whether you’re a bank, wealth management firm, or insurance provider.

We help you:

- Implement FSC’s industry-specific data model for clients, households, financial accounts, and policies

- Customize record types and workflows for banking, wealth, or insurance use cases

- Enable a unified view of clients across branches, advisors, and digital channels

FSC Migration Assessment & Implementation

Transitioning from a legacy CRM or spreadsheet-based system? Our FSC migration assessment service evaluates your current state, identifies gaps, and builds a roadmap for seamless migration to Salesforce Financial Services Cloud.

We help you:

- Conduct a comprehensive assessment of your existing systems

- Map data from legacy platforms to FSC’s data model

- Migrate customer, policy, and financial account data with zero downtime

- Train your team to confidently use your new FSC environment

Regulatory Compliance & Audit Trail Enablement

We configure your CRM to align with financial regulations and internal security policies without adding friction to your workflows.

We help you:

- Enable end-to-end audit trails, field-level encryption, and event monitoring

- Set up role-based access and data sharing rules

- Automate KYC, AML, and document management processes

Legacy CRM & Data Migration

Still using spreadsheets or outdated tools? We migrate and clean your data, configure Salesforce Financial Services Cloud to suit your operations, and ensure your team is ready to go from day one.

We help you:

- Migrate customer and policy data from legacy systems

- Map historical data to FSC’s object model

- Train your staff to confidently use your new CRM

Third-Party Platform Integrations

A modern CRM must connect to your broader tech stack. We ensure Salesforce works seamlessly with your portfolio, core banking, and underwriting systems.

We help you:

- Integrate with platforms like Avaloq, FIS, Temenos, Envestnet, and Guidewire

- Sync data across CRM, policy admin, trading, and reporting platforms

- Build a 360° view of your clients across all departments

What a Salesforce Financial Services Cloud Partner Brings to Your Business

Implementing Salesforce Financial Services Cloud effectively means aligning it with your data model, regulatory requirements, and existing systems. Here are the key areas where specialized consulting adds real impact:

Data Modeling & Compliance Alignment

FSC includes a pre-built data model for financial services with person accounts, household structures, financial accounts, assets, liabilities, and more. A Salesforce financial cloud consulting partner ensures this model is configured to reflect your real-world client relationships while adhering to regulatory frameworks like FINRA, GDPR, and SEC guidelines.

Automated Relationship Management & Servicing

From automated onboarding journeys to triggered client reviews and service case routing, a consulting partner helps you leverage Salesforce Flow, OmniStudio, and FSC Action Plans to streamline every stage of the customer lifecycle.

Integration with Core Banking, Portfolio, and Policy Systems

Financial institutions rely on complex legacy systems, from core banking platforms to portfolio management tools and policy administration systems. A seasoned Salesforce Financial Cloud consulting partner ensures FSC integrates securely with tools like Avaloq, Temenos, Envestnet, Orion, and more via APIs and MuleSoft.

Strengthen How Financial Industries Connect, Serve, and Grow

Wealth Management

For investment firms, private banks, family offices, and independent financial advisors, we build advisory tools that help deepen client relationships and streamline daily operations.

We help you:

- Track portfolios and financial goals in real time

- Automate client review cycles and compliance checklists

- Segment clients by net worth, risk tolerance, and life stage

- Provide financial advisors with 360° client views for better service delivery

Insurance Companies

We configure FSC for insurance providers, including life, health, and property & casualty insurers, to manage policyholders, agents, claims, and renewals in one unified platform.

We help you:

- Centralize policy, quote, and claims data

- Automate agent onboarding, territory management, and lead distribution

- Improve customer service with pre-built insurance workflows and case management

Banking Services

We empower retail banks, commercial banks, and credit unions to deliver personalized, omnichannel experiences while improving cross-sell, onboarding, and client retention rates. Our Salesforce for banking solutions integrates seamlessly with your existing infrastructure.

We help you:

- Personalize offers for loans, deposits, and investment products

- Integrate FSC for banking with core banking systems for real-time insights

- Track interactions across branches, mobile apps, and call centers

- Enhance member experiences for credit unions with specialized workflows

Loan Origination

Streamline your lending operations with Salesforce for lending solutions that manage the entire loan lifecycle from application to approval to servicing.

We help you:

- Automate loan origination and underwriting workflows

- Track applications, approvals, and disbursements in one system

- Integrate with loan management systems and credit bureaus

- Improve borrower communication and transparency

Investment Finance

For investment banks, private equity firms, and venture capital firms, we build deal management and relationship tools powered by Salesforce FSC.

We help you:

- Track deals, pipelines, and investor relationships

- Manage portfolio companies and fund performance

- Automate due diligence and compliance documentation

- Deliver Salesforce for investment banking and Salesforce for private equity workflows

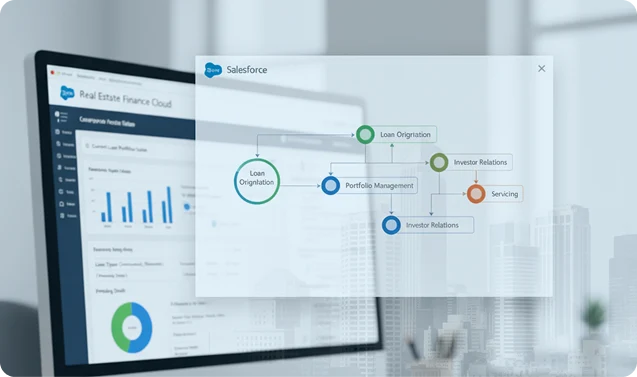

Real Estate

Whether you’re a REIT, commercial real estate lender, or property investment firm, we configure Salesforce for real estate operations to manage properties, investors, and transactions.

We help you:

- Track properties, valuations, and investment performance

- Manage investor communications and distributions

- Automate deal flow and transaction management

- Integrate with property management and accounting systems

Bridge compliance, client trust, and growth, all in one platform with a Salesforce Financial Services Cloud Consulting partner.

Why Financial Institutions Trust Folio3 for Salesforce CRM Solutions

At Folio3, we’ve helped banks, insurance providers, investment firms, wealth managers, financial advisors, and specialized institutions like private equity firms and real estate finance companies modernize how they engage clients, deliver services, and stay compliant, all within the Salesforce ecosystem.

With deep domain expertise and a certified team of Salesforce professionals, we build Financial Services Cloud solutions that match your business model, scale with your growth, and align with your regulatory responsibilities.

Here’s why we’re trusted worldwide:

ISO 9001

Certified infrastructure to deliver compliant solutions

ISO 27001

Certified security management systems that ensure data integrity and privacy

Our Portfolio of Successful CRM Solutions

Glass Flow

An established glass, glazing, and door installation provider in California sought a more connected operational framework. Their teams handled a growing workload but lacked the tools to align sales, dispatch, and field service.

Major Key Technologies, our success is measured by the milestones our clients achieve. Explore how we've empowered businesses with cutting-edge solutions, driving growth and innovation.

We helped Wealth Architects improve their email system by connecting Salesforce with Outlook and Gmail. We set up automatic lead creation from emails and made a custom Salesforce app for secure access. We also added DocuSign to make signing documents easier.

Folio3 helped Electrocore enhance their Salesforce CRM by improving sales cycle tracking and service delivery while ensuring HIPAA compliance. We integrated Salesforce with marketing automation and Oracle NetSuite ERP for a streamlined order-to-cash process. The solution also improved data synchronization and provided better insights for customer engagement.

Global Enterprises Count on Folio3

Majorkey

We used Folio3 over the last 3+ years for many projects, including org merges, complicated workflows and enhancements. Folio3 is was very detailed in the work. They are experts. They can explain complicated tasks so even the novice in the room can understand. Appropriate and reasonable timelines are assigned so that there are no issues with any tasks for transition. The project closed without any hang ups or hold ups and we continue to do enhancements on the application with Folio3.

Sunhero

Folio3 did a great job in scoping the request and keeping communication going throughout the task This was a very ambiguous request and they managed to troubleshoot the issue and explore different options. I would hire them again

Frequently Asked Questions (FAQs)

A Salesforce Financial Services Cloud consultant helps banks, wealth management firms, insurance companies, financial advisors, and lending institutions implement and customize Salesforce FSC to meet their specific business needs. They configure the platform’s data models, automate workflows, integrate third-party systems, and ensure regulatory compliance. A skilled FSC consultant turns Salesforce into a powerful CRM tailored for financial services operations.

Salesforce for banking and FSC for credit unions provide institutions with a unified platform to manage customer relationships, automate loan origination, track member interactions, and deliver personalized financial products.

Working with a Salesforce FSC consultant ensures your CRM is set up correctly from the start, with features like:

- Customized FSC financial data model for banks and credit unions

- Automated onboarding, compliance, and service processes

- Integration with core banking systems

- Enhanced data security and regulatory compliance

Salesforce for financial advisors and Salesforce for wealth management deliver tools that help advisors track client portfolios, automate review cycles, and manage household relationships. FSC for wealth management enables advisors to:

- Maintain comprehensive client profiles with financial goals and risk tolerance

- Automate compliance checklists and client communication

- Track performance across multiple accounts and asset classes

- Deliver personalized advisory experiences at scale

Yes, Salesforce for insurance and FSC for insurance providers offers specialized features for life, health, and property & casualty insurers. The platform helps insurance companies manage policyholders, agents, claims, and renewals while maintaining compliance with industry regulations. A consultant can configure FSC to automate agent workflows, centralize policy data, and improve customer service.

An FSC migration assessment is a comprehensive evaluation of your current systems, data, and workflows to create a strategic roadmap for migrating to Salesforce Financial Services Cloud. This assessment identifies data quality issues, maps legacy data to FSC’s object model, and develops a phased implementation plan that minimizes disruption to your operations.

Absolutely. Salesforce for lending solutions streamlines loan origination, underwriting, and servicing processes. FSC integrates with loan management systems to provide lenders with a complete view of the borrower relationship, automate approval workflows, and track loan performance throughout the lifecycle.

A qualified Salesforce Financial Services Cloud consultant should have:

- Salesforce FSC Consultant Certification

- Experience with FSC’s data model (e.g., clients, households, financial accounts)

- Knowledge of financial services processes across banking, wealth, and insurance

- Expertise in Salesforce tools like Flow, OmniStudio, Shield, and Experience Cloud

- Integration experience with core systems (e.g., Temenos, Envestnet, Guidewire)

The cost of hiring a Salesforce FSC consultant varies based on project scope, complexity, and region.

- Hourly rates can range from $100 to $250+ USD

- Fixed-scope implementation projects typically start around $25,000 for small firms and can exceed $200,000 for enterprise deployments.

Yes, Salesforce Financial Services Cloud is valuable for small and mid-sized banks. It offers scalable CRM tools that improve client onboarding, automate compliance, and deliver personalized financial experiences, all within a secure, cloud-based environment. With the right consultant, small banks can implement FSC efficiently and grow into the platform over time without unnecessary complexity.

Salesforce FSC implementation timelines vary depending on your organization’s size, complexity, and goals.

- Simple implementations: 6–8 weeks

- Mid-sized projects: 10–16 weeks

- Enterprise rollouts: 4–6 months or longer

Salesforce for real estate finance enables REITs, commercial lenders, and property investment firms to track properties, manage investor relationships, and automate transaction workflows. The platform provides visibility into property performance, investor distributions, and deal flow management.

A qualified Salesforce Financial Services Cloud consultant should have:

- Salesforce FSC Consultant Certification

- Experience with FSC’s data model (e.g., clients, households, financial accounts)

- Knowledge of financial services processes across banking, wealth management, insurance, and lending

- Expertise in Salesforce tools like Flow, OmniStudio, Shield, and Experience Cloud

- Integration experience with core systems (e.g., Temenos, Envestnet, Guidewire)